Snack Market

Insights into the Snack Market

in Northern Malaysia

A Region Ripe with Opportunity

Malaysia’s snack market is a vibrant and growing sector, with insights from platforms like Easy Wholesaler highlighting its continuous expansion and diverse consumer preferences. But amidst this national dynamism, are you overlooking a region brimming with untapped potential? We delve into the snack market of Northern Malaysia, revealing why this area presents a compelling opportunity for suppliers and manufacturers like you.

A Substantial Market Ready for Growth

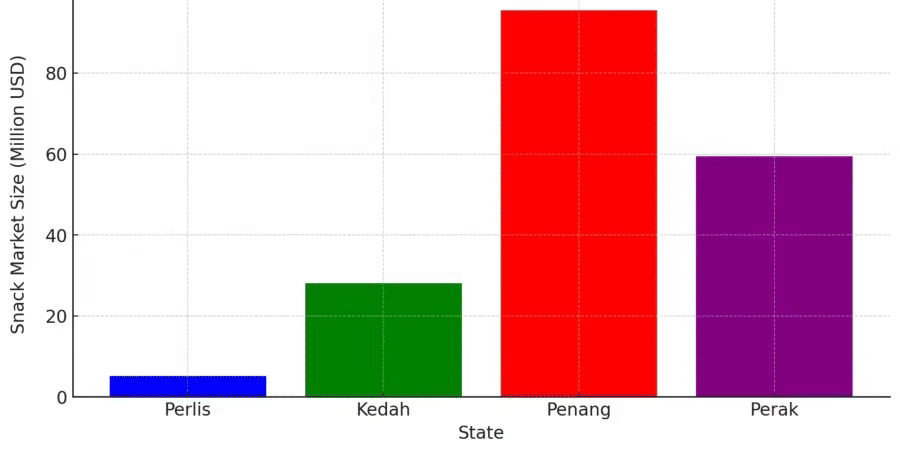

While the national snack market commands attention, the Northern Malaysian region, encompassing Perlis, Kedah, Penang, and Perak, carves out a significant space of its own. Estimated at US$188 million in 2025, this is not a niche market – it’s a substantial sector with considerable consumer demand. This figure, grounded in economic and population data, points to a robust appetite for snacks across these four states.

Penang: The Engine of the North, Fueling Snack Consumption

It’s impossible to discuss Northern Malaysia without acknowledging Penang’s pivotal role. As the economic powerhouse of the region, contributing over half of Northern Malaysia’s GDP (Statista GDP by State), Penang’s influence on the snack market is undeniable. With its thriving urban centers, bustling tourism industry, and a world-renowned diverse food culture, Penang is a key driver of snack consumption. We estimate Penang’s snack market alone to be around US$95 million, representing a significant portion of the regional total and highlighting its importance as a primary target market.

However, the story doesn’t end with Penang. While it leads the pack, states like Perak and Kedah also offer substantial contributions, driven by their own unique economic activities and consumer bases. Perak’s estimated snack market stands at approximately US$59 million, and Kedah’s at nearly US$28 million, showcasing the breadth of the opportunity across the region. Even Perlis, while smaller, presents a focused market with its own distinct consumer profile.

Understanding Regional Nuances: Tailoring Your Approach

Northern Malaysia isn’t a monolithic entity. The economic disparity across states translates into varied consumer behaviors and preferences. Penang, with its higher economic activity and urban demographic, likely exhibits a stronger demand for modern, convenient, and potentially healthier snack options, mirroring national trends towards healthier choices as highlighted by market analysis. The influx of tourists further amplifies this demand, creating opportunities for premium and innovative snack products.

In contrast, states like Kedah and Perlis, with their stronger agricultural roots and more rural landscapes, may present a market more inclined towards traditional snacks and locally sourced ingredients. This presents a different, but equally valuable opportunity: catering to consumers who appreciate authentic flavors and regional specialties. Perak, with its blend of urban and rural areas, likely embodies a mix of both preferences, offering a diverse landscape for snack manufacturers.

Market Trends and Consumer Preferences

National trends, from Euromonitor Savoury Snacks, show growth in healthier options like potato chips and savoury biscuits, driven by health consciousness, likely mirrored in Northern Malaysia. The region’s urban centers, especially Penang, may see higher demand for modern snacks, while rural areas might prefer traditional items, influencing distribution strategies.

Detailed Breakdown by State

To illustrate, a table of economic and population data for 2025 estimates:

| State | Population (2025, est.) | GDP 2023 (billion MYR) | GDP 2025 (est., billion MYR) | Share of Regional GDP (%) |

|---|---|---|---|---|

| Perlis | 273,000 | 6.5 | 7.2 | 2.7 |

| Kedah | 2,411,000 | 35.5 | 39.1 | 14.8 |

| Penang | 1,869,000 | 122 | 134.2 | 50.9 |

| Perak | 2,677,000 | 75.5 | 83.1 | 31.5 |

| Total | 7,230,000 | 239.5 | 263.6 | 100.0 |

Note: Population estimates adjusted for 1.3% annual growth; GDP for 2025 assumes 5% annual growth (World Bank GDP growth).

This table underscores Penang’s dominance, suggesting its snack market could be around 50.9% of the regional total, or approximately US$95 million, with the rest distributed among Kedah, Perak, and Perlis based on economic activity.

Seizing the Untapped Potential: A Strategic Imperative

For snack suppliers and manufacturers, Northern Malaysia is more than just a geographical region; it’s a spectrum of opportunities waiting to be unlocked. Ignoring this market means missing out on:

- A Significant Market Size: US$188 million in 2025 is a substantial figure that warrants serious consideration.

- Diverse Consumer Base: From the sophisticated urbanites of Penang to the more traditionally inclined consumers in Kedah and Perlis, there’s a market segment for every type of snack offering.

- Growth Potential: Aligned with the overall Malaysian snack market growth trajectory, Northern Malaysia is poised for further expansion, offering long-term potential.

Conclusion: Your Next Growth Frontier Awaits

Northern Malaysia is not just a subset of the Malaysian snack market – it’s a distinct and dynamic region with its own unique characteristics and considerable potential. By understanding the nuances of each state, tailoring your product offerings, and strategically approaching this market, snack suppliers and manufacturers can tap into a rewarding growth frontier. Don’t overlook the North; your next significant market success might just be waiting there.

Disclaimer: The data and analysis presented in this article are based on estimates, projections, and publicly available data. While efforts have been made to ensure accuracy, the figures provided—such as snack market size, per capita expenditure, and GDP contributions—are subject to change due to economic fluctuations, updated government statistics, and market dynamics. Therefore, the figures presented should be interpreted as projections and carry a degree of uncertainty. Users are advised to use this information cautiously and to seek updated data and professional advice before making any decisions based upon it.